With the help of a tax on water wells, the state investigates in which area and by whom the subsoil is developed, thus, citizens who conduct illegal activities in the extraction of water are calculated. That is, taxes control the environmental situation in the country and maintain its stability. Also, in most cases, the use of water must be licensed.

For example, if a well is of a tubular type (or mine), or rather it is an artesian source, then it must be licensed, and a tax is paid for it.

To be able to use natural resources, any person is required to obtain a license from the executive authorities. Excise duty on a well is the payment of cash to the state every quarter.

Do I have to pay tax on wells and wells

Any source must have a technical passport with its parameters and installation data, which during construction were provided to the Department of Subsoil Supervision of the Russian Federation. Some wells have limited volume to use. Payment for a water well is required if the source meets the following specifications:

Any source must have a technical passport with its parameters and installation data, which during construction were provided to the Department of Subsoil Supervision of the Russian Federation. Some wells have limited volume to use. Payment for a water well is required if the source meets the following specifications:

- The depth of the aquifer is from 40 to 250 meters;

- In water, a high concentration of natural salts and minerals.

- The mine is drilled into the lower layer of the water core.

- The water is clean and does not contain metal impurities.

The tax on wells and wells is not taxed if it meets the following conditions:

- The depth of the well or borehole is 5 to 20 meters, and sometimes 40 meters;

- The water intake is installed on a personal plot or cottage territory;

- The owner is not engaged in entrepreneurial activity;

- Wells and wells are in the sand, as they do not affect the water of natural resources;

- The volume of water used is calculated for residents of the house and watering the site;

- Wells for limestone, if the aquifer does not use central water supply (up to 80 meters).

Subject to the above points, it is possible to use freely water in summer cottages or regulatory authorities can conduct an inspection. Violators can both be warned and fined. If you continue to break, you will have to plug the well at your own expense.

Regulatory laws

Subparagraph 13, paragraph 2 of Article 333.9 of the Tax Code of the Russian Federation states that the use of water for irrigation of summer cottages and other personal households of citizens is not subject to taxation on water tax.

Subparagraph 13, paragraph 2 of Article 333.9 of the Tax Code of the Russian Federation states that the use of water for irrigation of summer cottages and other personal households of citizens is not subject to taxation on water tax.

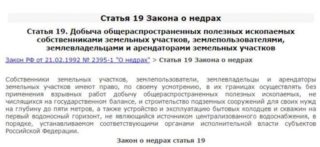

Law No. 2395-1 “On Subsurface Resources” allows summer residents and owners of cottages to use a well for watering the garden and watering pets.

Law No. 3314-1 establishes the procedure for licensing and operating wells. All types of sources are identified that should and should not be taxed.

Clause 3 of Article 7 of the Administrative Code of the Russian Federation provides for sanctions in the form of a fine for the use of an unregistered well.

Very significant fines are imposed on violators.

- For leaders of the organization - from 30,000 to 50,000 rubles.

- For legal entities - from 88 to 100 rubles.

- For individuals - 3,000 to 5,000 rubles.

Terms of payment and tax value

The artesian horizon is the most important and key strategic supply of clean water, it is considered a natural asset along with minerals, so the tax on the use of an artesian well is so high.

The artesian horizon is the most important and key strategic supply of clean water, it is considered a natural asset along with minerals, so the tax on the use of an artesian well is so high.

The tax cost can be different, the size depends on the region of location and many other factors.

Individuals using water from an artesian well for personal purposes pay 81 rubles for one thousand cubic meters.

Businessmen, water supply organizations and other facilities have different payment rates, estimated cost varies in the range from 300 to 754 rubles per thousand cubic meters. Detailed rates can be found in the department of the Federal Tax Service or on the official website of the service.

It is important to know that there is a restriction on the use of water for all; if the specified norm of consumed water is exceeded, the tax rate increases 1.15 times. All limits can also be found in the department of the Federal Tax Service or on a special site.

The tax at the IFTS must be paid no later than the 20th day of the next month after the next quarter. Thus, the dates for payment are:

- January 20th;

- 20 April;

- July 20;

- The 20th of October.

In cases where payment for a well is past due, a penalty is charged. It is also necessary to submit a report to the department of the Federal Tax Service, where water withdrawal is registered.

Procedure for submitting a declaration

The legislation of the Russian Federation specifies the procedure for the declaration of payment of tax for the use of water.

First you need to get acquainted with all the documentation that will be required for the tax service. According to the standard, these are the following documents:

- A journal that monitors water levels;

- Tax return;

- License for exploitation or drilling of a source (in order to obtain it, it is necessary to collect and provide a lot of papers: cadastral certificate, protocol for water analysis, restriction on pumping water, a journal that controls water consumption and necessarily copies of the documents listed);

- Passport to the well;

- Conclusion on the sanitary zones.

Now you need to prepare and present the tax return itself. It will consist of a title page and paragraphs that contain the following information:

- The amount of tax payable depends on the place of registration of the well and the amount of water consumed;

- Calculation of the tax base and the amount of water tax when taking water from a water body;

This declaration is a tax authority operating in the tax period. If the declaration is correctly prepared and filed, then the tax will be recalculated, in which tax audits conducted by specialized services for a certain period of time are not taken into account.

The declaration must be presented only on paper, and not in electronic form. All information must be filled in by hand. It is also possible to produce a document printed on a printer. Further, the document is signed by the employees checking the declaration and certified with the organization’s seal or stamp.